What is a custodian account?

A custodian account is an account where a custodian (a financial institution) holds the securities or assets of an investor, typically NRIs or institutional investors. Custodians safeguard these assets and ensure compliance with regulatory requirements, particularly for trades like Futures & Options (F&O).

What is Orbis?

Orbis is a third-party platform that manages custodial services for NRIs or foreign investors. It facilitates compliance and oversees the settlement of NRI funds for transactions routed through custodian accounts.

Who Needs to Map a Custodian Account?

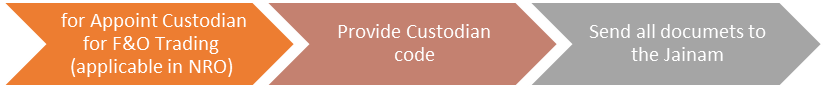

Mapping a custodian account is mandatory for clients who wish to trade in the Futures & Options (F&O) segment. NRIs and FPIs must map their custodian accounts with Jainam Broking to ensure compliance with SEBI and RBI regulations.