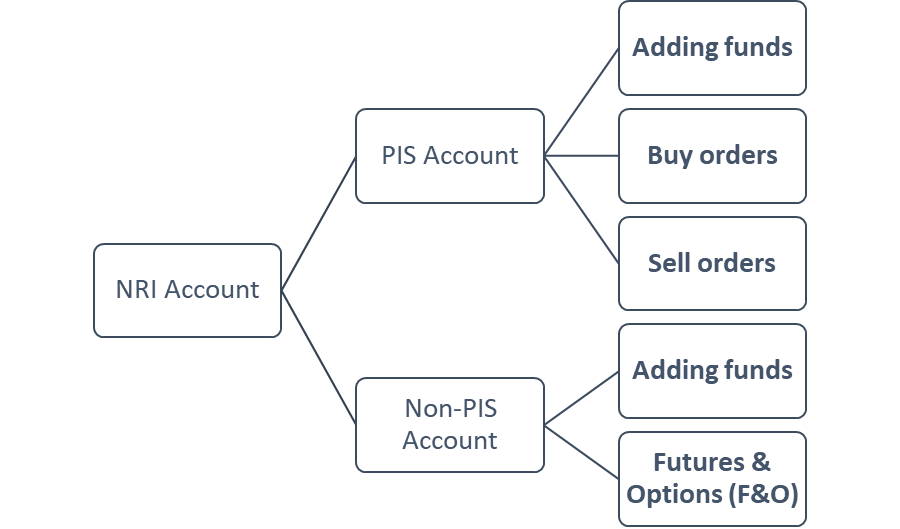

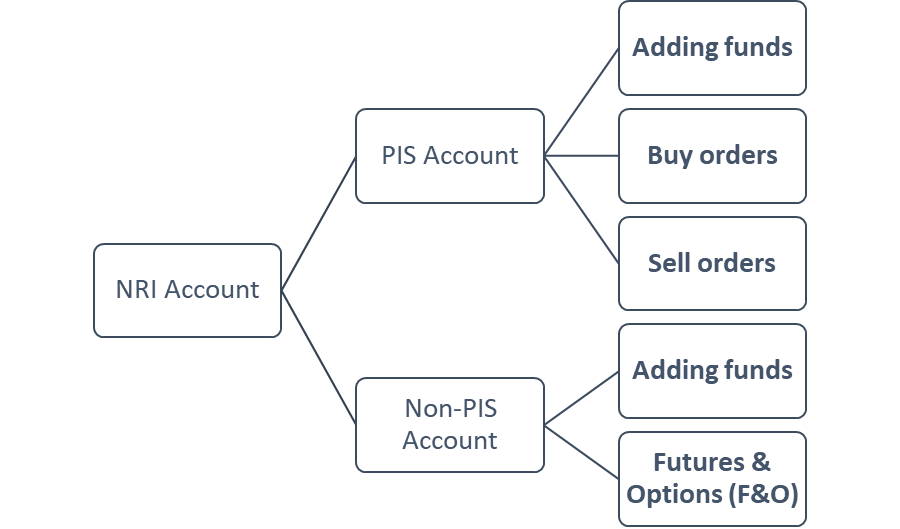

For PIS accounts: - Adding funds: To add funds to your PIS bank account, you must allocate them from the NRE or NRO bank account. At the end of each day, the bank will send a report to Jainam with the PIS balance, which is then updated as margins in the Jainam account before the market opens on the next trading day.

- Buy orders: When you purchase a stock, Jainam will send a buy contract note to the bank at the end of the day. The bank will then debit the PIS account and credit Jainam one working day after the transaction day (T+1).

- Sell orders: After selling stock from your Demat account, Jainam will send a sell contract note to the bank at the end of the day to calculate TDS. The proceeds from the sale will be credited to the PIS bank account the next working day after the transaction day (T+1).

For NRO Non-PIS account: - Adding funds: Funds can be transferred directly to the Jainam account via the payment gateway, NEFT, RTGS, and IMPS. For NRO NON-PIS accounts, the trading process is similar to a resident individual account, with the only difference being that the NRO bank account is mapped with Jainam.

- Futures & Options (F&O): NRIs can trade in the F&O segment through an NRO account. A Custodial Participant (CP) code is required for trading in the F&O, and all funds for trading F&O will be with the custodian.

|