When does settlement takes place?

When does settlement takes place? | ||||||||||||||||||

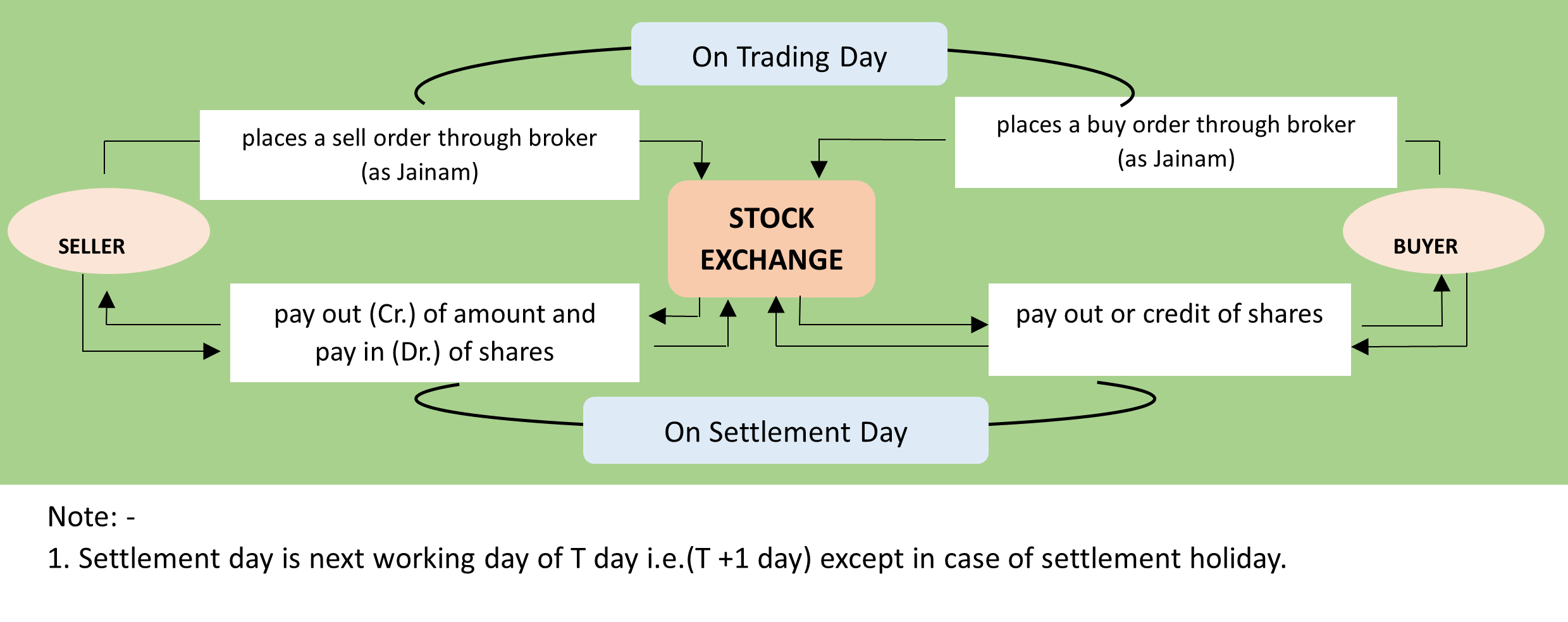

Settlement is the process of transferring securities from seller to buyer and the transfer of funds from the buyer to the seller. The settlement cycle is the time required for a trade to be settled. Currently on Indian exchanges, the settlement cycle for all traded instruments is T+1 day, where T represents the trade day. Equity Segment: F&O Segment: | ||||||||||||||||||

Let’s understand the settlement day with an example of a week where Thursday is a settlement holiday :

| ||||||||||||||||||

On the basis of the above example, we can conclude that trades executed on a settlement holiday (here, Thursday) and 1 day prior to a settlement holiday (Wednesday) will be settled on the next working day after the settlement holiday (here, Friday). | ||||||||||||||||||

|