How can shareholders get the application form for the Rights issue? - From Issuer : - The issuer shall dispatch a common application form to its shareholders as on the record date. The issuer shall also send the details of the rights entitlements of the shareholder separately. This application form can be used both by shareholders or renouncee.

- From the Registrar to Issue:- The registrar to the issue shall also upload the application forms on its website.

- In terms of Regulation 78 of the ICDR Regulations, the investor also has the option to make an application in writing on plain paper.

Applicants can use the application form available on the website of the registrar to the issue or printed forms sourced from the issuer or merchant bankers.

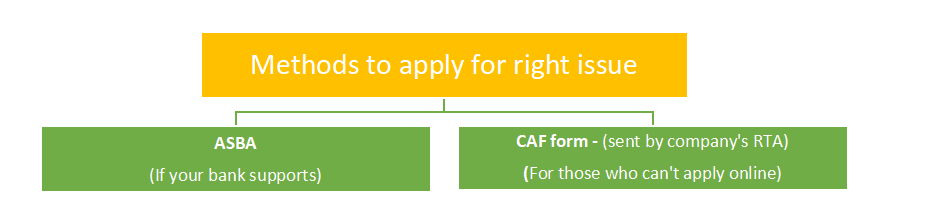

Where can I apply for the rights issue?

The RTA will put up the exact link on their website once the issue is live. The same goes for the banks which will support the issue.

What happens to the Rights Entitlements (REs) in the form of temporary demat securities if they are not renounced or exercised before the trading window closes?

The REs will lapse, and the holder will lose the premium paid to acquire them.

Can applicants who are not existing shareholders of the issuer company as of the record date/ex-date apply for the rights issue?

Yes, by purchasing the REs, a person who is not an existing shareholder of the issuer company can apply for the rights issue.

|