What is the process to open an NRO (Non-PIS) account with Jainam? |

- Non-Resident Indian (NRI) accounts with Jainam can only be opened offline. However, clients can select to open either an NRO Non-PIS account or an NRE-PIS account by filling out the account opening application and submitting it to Jainam.

- Types of NRI Accounts at Jainam:

- NRE (Non-Resident External) Account –PIS Account: Used for investing in Indian stock markets under the Portfolio Investment Scheme (PIS).

- NRO (Non-Resident Ordinary) Account – Non-PIS Account: Suitable for managing income earned in India, such as rent and dividends.

- Joint Account: Can be opened with a resident Indian as a joint holder, but with restrictions on investment activities.

|

|

- A Portfolio Investment Scheme (PIS) account requires a permission letter from the RBI to buy and sell shares in the Indian markets. This permission letter must be obtained through one of Jainam's partner banks.

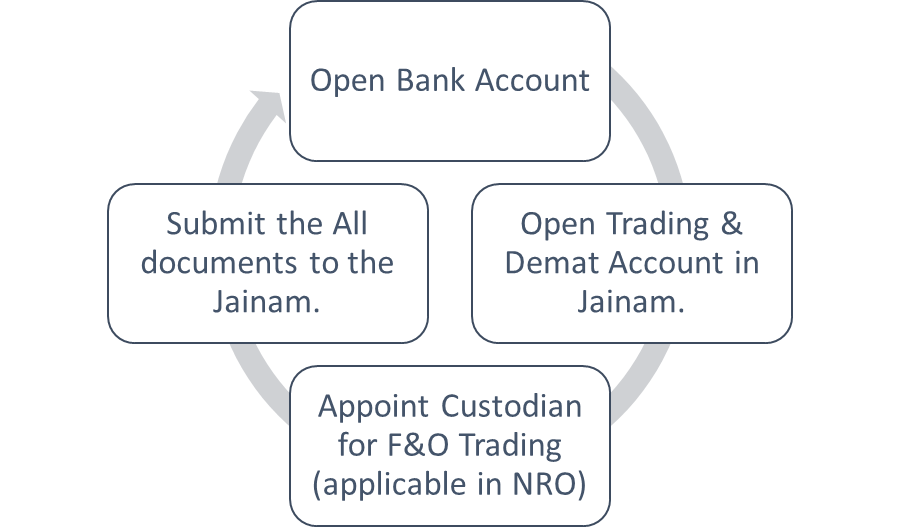

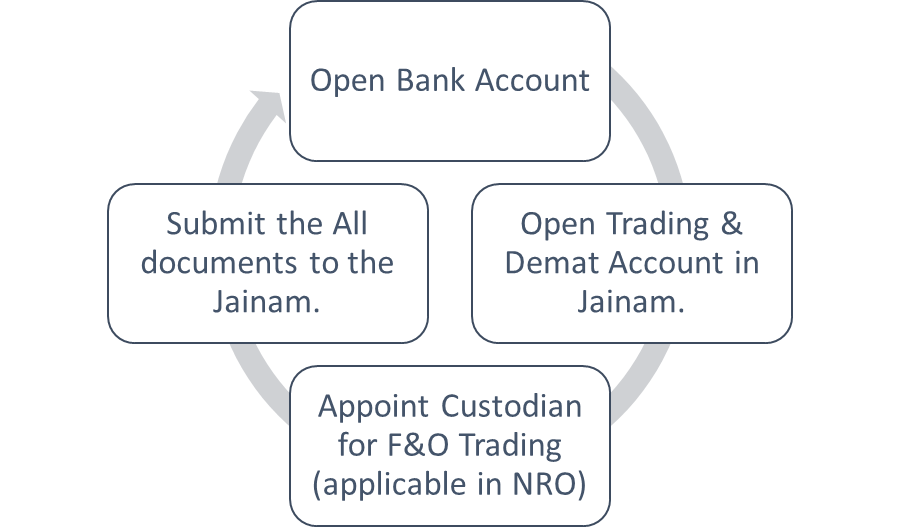

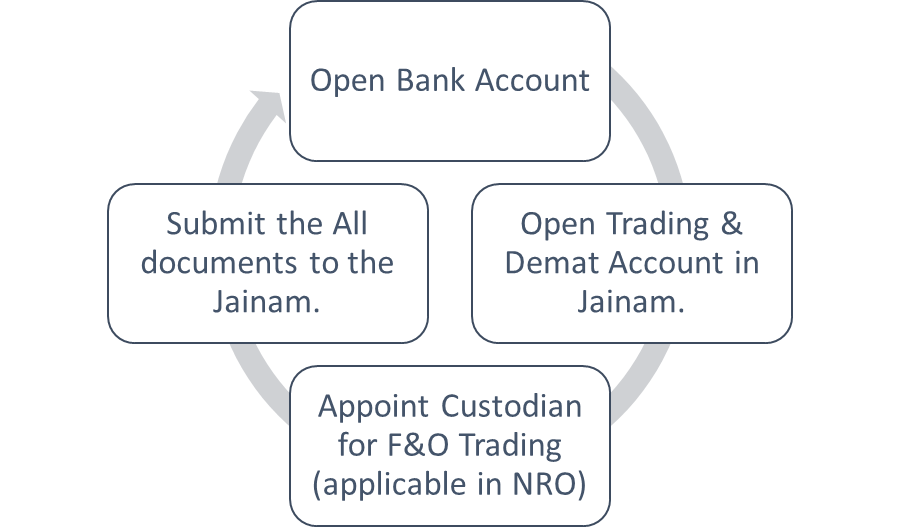

- For open NRO (Non-PIS) account opening, follow the process below:

- Step 1: Open a Bank Account

- For NRO Accounts: Open a regular NRO Savings Bank account (no PIS letter required).

- For NRE Accounts:

- Open an NRE Savings Bank Account with a bank empaneled by Jainam Broking.

- Obtain a Portfolio Investment Scheme (PIS) letter from the bank.

- Step 2: Open Trading and Demat Account with Jainam

- Download the NRI Account Opening Form from Jainam. To view sample filed form, see the NRI sample filled form

- Fill out the form and gather all necessary documents from the below checklist.

- Step 3: Courier the completed form and documents to the Jainam office at the below address:

- Jainam Broking Limited

Jainam house,

Kargil Chowk,

Piplod,

Surat-395007 - Step 4: Transfer from Another Broker (if applicable)

- If you are already dealing with another broker and have an existing PIS account, you must provide a revocation letter to transfer your account to Jainam Broking.

- Revocation (if applicable): If the client is currently dealing with another broker and already possesses a PIS account, a revocation letter must be provided to cancel the previous authorization.

|

Documents required check list for Account opening: | Documents Required for NRI Account Opening | | Particular | List of Documents | NRE | NRO | | Passport-size Photo |

| yes | yes | ID Proof:

| PAN Card (Mandatory) | YES | YES | Passport (valid) (with first & last page of passport) | YES | YES | Latest Address Proof : (India) Any One | - Driving license or

- Foreign passport ( check validity of passport) or

- Utility bills not older than last 2 months (as per telephone bills, electronic bills & gas bills) or

- A bank statement or

- Rental agreement or lease or sale deed or Nationality holder card (green card).

| Yes | Yes | self-attested copy of the overseas/foreign address proof | - Driving license or

- Foreign passport (check validity of passport) or

- Utility bills not older than last 2 months (as per telephone bills, electronic bills, and gas bills) or

- A bank statement or

- Rental agreement or lease or sale deed or Nationality holder card (green card).

| Yes | Yes | Bank Account | Saving Account | yes | yes | | PIS Account | Mandatory | Optional | PIS Letter from Bank | PIS Letter. | Mandatory | Optional | Authorization Letter | LOA | Mandatory | Optional | Bank Proof | - Cancel Cheque

- Copy of passport or

- Copy of bank statement

| yes | yes | DP Account | CMR Copy | yes | yes | Custodian Details | | No | YES |

NOTES: - FEMA declaration (Foreign Exchange Management Act)

| - A cancelled Cheque of the savings account of the NRI can be an NRE

| - If you have a Foreign passport, provide PIO/OCI card.

| - If you have an Indian passport, provide Photocopy of passport with VISA Arrival page

| - FATCA Declaration Form - Foreign Account Tax Compliance ACT

| - LOA (Letter of Authority) , DP Client Master with KYC

| - Client signature should be match PAN/passport; otherwise, client has to give bank letter for signature verification.

| - The client can change his status from NRI to NRI, NRE to NRO, and NRO to NRE by fulfilling all required compliances.

| - Demat Debit and Pledge Instruction (DDPI) allows brokers to debit securities from the Demat account and deliver them to the exchange.

| - DDPI is optional. Clients who do not want to submit DDPI can authorise the sale of securities using CDSL T-PIN

|

|

RELATED FACTS: NRI clients can invest through a SEBI-registered broker. For which client has to open Trading and DP Account in NRI Status with Broker.

After receiving all the documents, the account will open within 4 days.

The client can open an NRE as well as an NRO trading account.

For settlement of trade, the client has to open a bank account with Broker Empanel Bank. For NRE clients, they have to open two bank accounts (NRE PIS & Savings). Bank issue PIS letter to open NRE account. For NRO clients, PIS accounts are not mandatory; hence, the client has to open a savings account with NRO status.

All NRE-PIS account fund settlements take place through PIS bank accounts, and the bank will report all transactions of the client to the RBI.

There are certain company-wise limits to investing in securities.

NRI-NRO The client can trade in equity derivative segment by appointing a custodian to settle his derivative trades.

The NRI client can’t do intraday trades or short selling of the securities.

For trading in “Security under Caution List,” the NRI client has to get approval from RBI where the NRI investments are nearing the threshold limit.

NRI Client cannot trade in “Security under Banned List.

NRI Client cannot trade in commodity derivatives and currency derivatives.

For more details, see NSE

|