What is a PIS letter, and how to get it?

What is a PIS letter, and how to get it? |

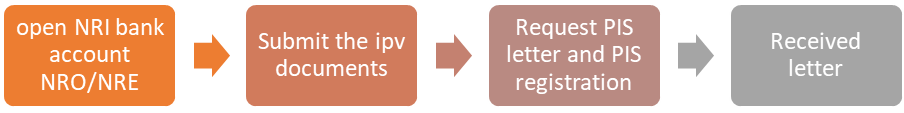

The Portfolio Investment Scheme (PIS) is a scheme by the Reserve Bank of India that allows non-resident Indians (NRIs) to buy or sell shares of listed Indian companies. NRIs can obtain the PIS letter through the bank where their NRE or NRO account was opened. It's important to note that only designated branches of a bank are authorized by the RBI to administer the PIS. NRIs must have a PIS account with any one of the following banks: Axis, Yes, icici, or Hdfc. Only where you can get your PIS letter from the banks. How to get it: NRIs can get the PIS letter with the help of the bank where the NRE or NRO account was opened. RBI has authorized only designated branches of a bank to administer the PIS. |

|

RELATED FACTS: For NRE accounts: Yes, a PIS letter is required, as RBI permission is needed. For NRO accounts: The PIS letter is typically not required, but you still need to comply with the regulatory framework set by RBI and FEMA for any stock market investments. In the PIS letter, you must mention the specific branch address of the authorized bank that is approved by the RBI for PIS transactions. This should be the branch where your PIS account is either currently maintained or is intended to be opened. |