How to understand a contract note? |

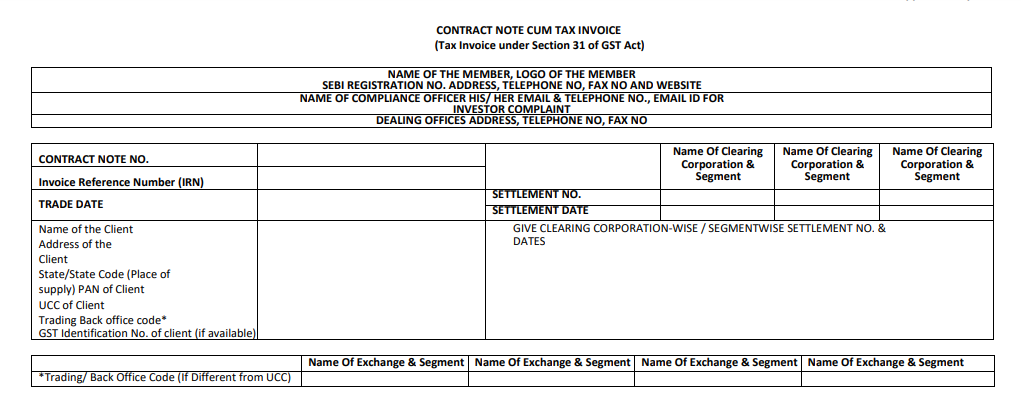

A contract note is the official record of all transactions made through a stockbroker on a stock exchange, detailing the trades executed on a specific day. It is sent on the registered mail ID of Jainam account holders on the trade date. The contract note can also be downloaded from J Plus. To know more, is a contract note and how to download it? The format of contract notes has changed from August 1, 2024, as per the SEBI circular (WEB). It now includes broker & client information, such as the broker’s name, SEBI registration number, and contact details, along with client details like name, PAN, unique client code (UCC), and registered address. Additionally, it specifies the trade date & settlement date, indicating when the trade was executed and when funds/securities are settled. |

|

|

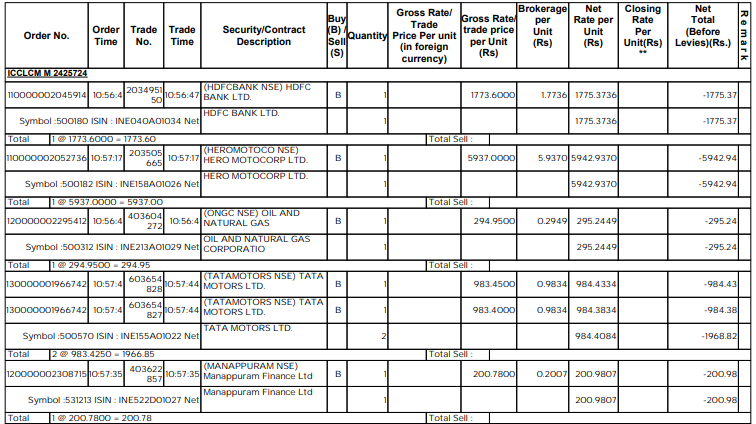

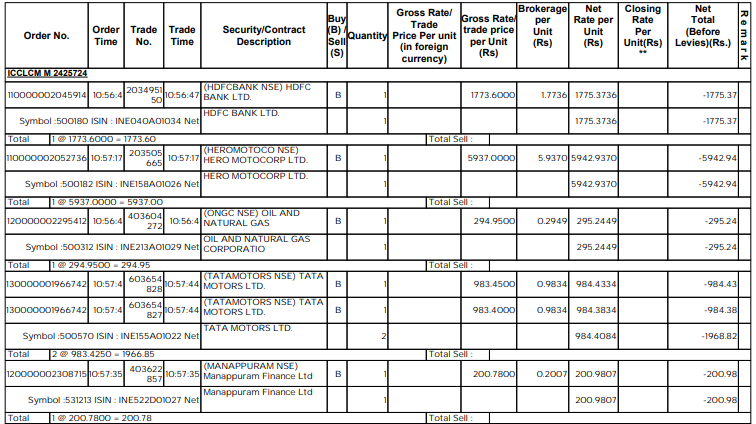

This section contains details of all trades executed as: Column | What It Means | Order No. & Trade No. | Unique ID for tracking trades. | Symbol | Stock/contract ticker symbol (e.g., HDFCBANK, TCS). | ISIN | International Security Identification Number for the stock/contract. | Buy (B) / Sell (S) | Indicates whether the transaction is a purchase or sale. | Quantity | Number of shares/contracts traded. | Gross Rate per Unit | Price per share/contract before charges. | Brokerage per Unit | The brokerage fee applied per unit (varies based on broker and trade type). | Net Rate per Unit | The final price after adding brokerage. | Closing Rate (Derivatives Only) | The last traded price at the end of the day. |

|

Trade Details from the Contract Note:

A contract note provides a breakdown of executed trades, including stock details, buy/sell status, quantity, gross rate, brokerage, and net rate per unit after charges.

For example, if you purchase HDFC Bank Ltd. (1 share at ₹1,773.60) and Tata Motors Ltd. (2 shares at ₹983.425 each), the calculations are as follows:

Total Buy Value = Quantity × Gross Rate per Unit

HDFC Bank: ₹1,773.60

Tata Motors: ₹1,966.85

Net Buy Value = Total Buy Value + Brokerage

HDFC Bank: ₹1,775.37

Tata Motors: ₹1,967.83

Weighted Average Price (WAP) = Total Buy Value ÷ Total Quantity

Tata Motors: ₹983.425

Net total (Before Levies) = Quantity × Net Rate per Unit |

|

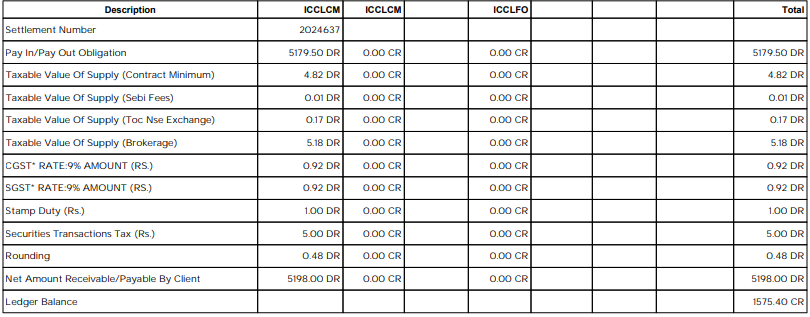

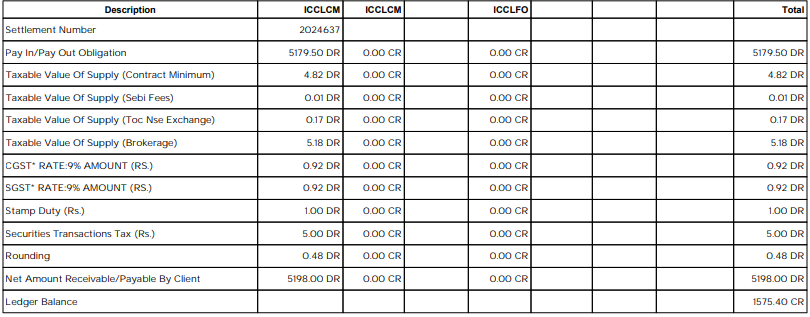

"CR" (credit) means the amount is receivable by the client and "DR" (Debit) means the amount is payable by the client.

The final pay-in or pay-out amount does not just consider the net total (before levies) because additional charges are applied, such as GST (on brokerage), STT (Securities Transaction Tax), exchange charges, stamp duty, and SEBI turnover fee.

The final pay-in/pay-out amount = (total buy value / Total Sell Value) + Charges - Taxes. |

RELATED FACTS: - Brokerage is not fixed and varies based on broker, trade type, and brokerage plan. STT, stamp duty, and SEBI fees are government taxes.

- Other charges, such as call, trade, and DP charges, are not displayed on the contract note.GST is applied only on brokerage and exchange fees.

- Total Buy Value (Right Side) → accrues when you purchase stocks. Total Sell Value (Left Side) → displayed when you sell stocks.

|