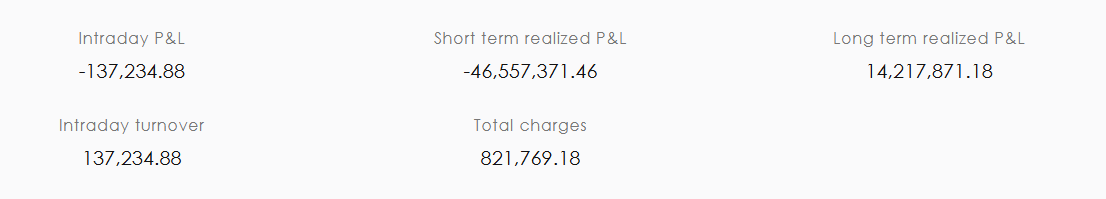

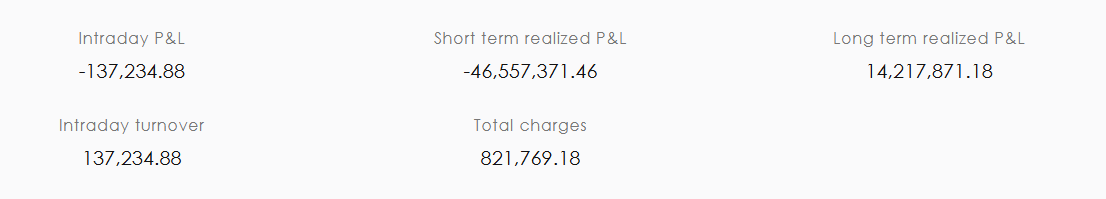

- To calculate the short-term and long term capital gain in Jainam's tax P & L report, all segments are combined.

- Charges such as brokerage, stamp duty, STT, exchange transaction charges, SEBI charges and the applicable GST are not deducted while calculating capital gain in Jainam's tax P & L report.

- Details about securities transferred from another Demat account to Jainam account will not appear in the Tax P&L report, as Jainam cannot verify the buy price paid by the client.

- Jainam's tax P&L report shows correct calculation of capital gains in case of corporate actions like

- Bonus – Free additional shares issued to existing shareholders based on their current holdings.

- Splits – Division of existing shares into multiple ones, reducing face value per share but not overall value.

- Rights Issue – Offer to existing shareholders to buy additional shares at a discounted price.

- Merger – Two companies combine; shareholders may get shares of the new entity as per a swap ratio.

- Spin-Offs – A new company is created from a parent, and shareholders receive proportionate shares in the new entity.

- Buyback – Company buys back its own shares from the market, reducing outstanding equity.

RELATED FACTS: - Long-term capital gains (LTCG) apply when a stock is held for more than 1 year, whereas short-term capital gains (STCG) apply when a stock is held for less than 1 year.

Jainam's tax P&L will not show results for the case of securities transferred from another Demat account to Jainam account. Such transactions will be shown as 'Liablities' in excel and as sale of stock(puchase data unavailable in Pdf) of tax P & L report at Jainam. To enter buy price in such case see, How can I enter buy price of shares transferred off market to my Jainam account?

|