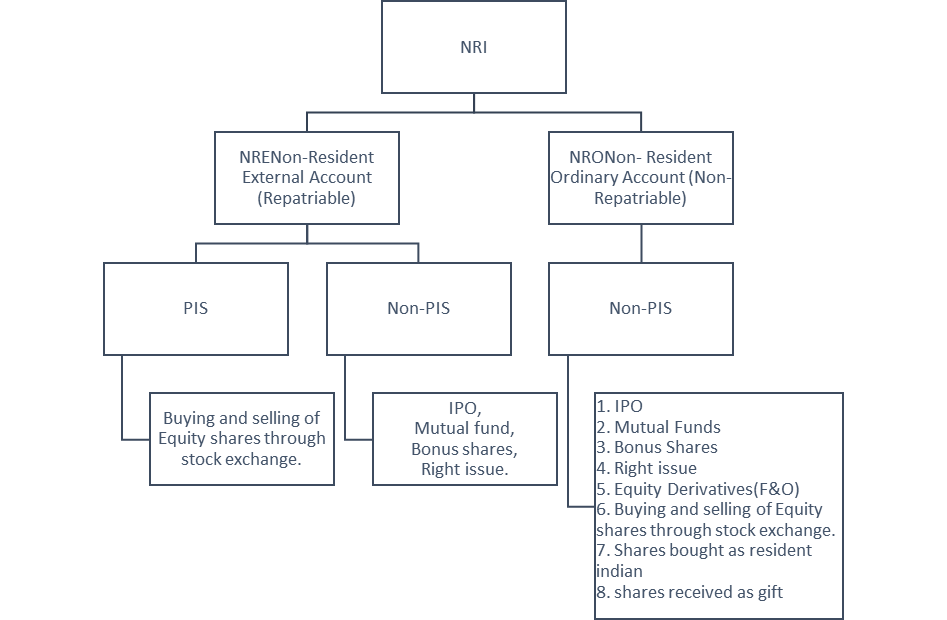

What are the types of NRI accounts based on repatriability?

|

|

RELATED FACT NRI clients can invest through SEBI-registered brokers by opening a Trading and DP Account in NRI status, with the option to open both NRE and NRO Trading Accounts. NRE clients need two bank accounts (NRE PIS and Savings) and a PIS letter, while NRO clients only need a savings account, as PIS is not required. NRE Accounts offer repatriation benefits, tax exemptions, and DTAA advantages, with transactions reported to the RBI. Investments are subject to company-wise limits, and NRI-NRO clients can trade equity derivatives with a custodian. NRIs cannot engage in intra-day trades, short-selling, or trade in commodity/currency derivatives. Caution list securities require RBI approval if near the investment threshold, while trading in banned list securities is prohibited. |